As prominent financial and mobility service providers gear up to harness the potential of AI and computer vision in their upcoming digital offerings, now is the moment to take a closer look at those privacy-preserving solutions that are an inevitable part of usage-based insurance (UBI).

UBI policies will emerge as the driving force in reshaping the auto insurance sector. These policies usher in an era of more individualized and economically viable coverage choices for policyholders, thereby ensuring an elevated level of service quality.

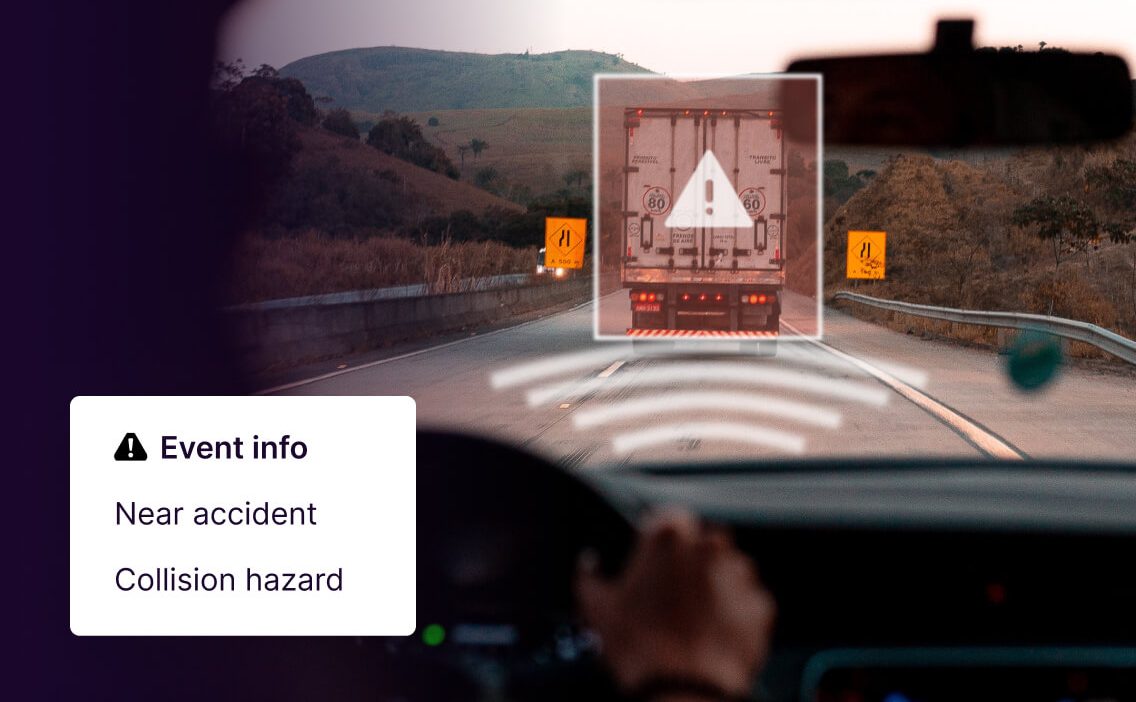

It comes, however, with a significant element that cannot be ignored – the use of Computer Vision and AI generates amounts of data that are already hard to manage. Peregrine faces this challenge by identifying in real-time during the drive the events that are of interest to insurance providers. Only for these events, data will be uploaded and stored in the cloud.

Adding a level of complexity to handling data, service providers are required to ensure that the data is stored securely and processed following data protection principles. Building a digital service which complies with the General Data Protection Regulation (GDPR) becomes indeed a challenge to the fast and coherent adoption of the next generation UBI in the EU.

In the case of insurance policy, the use of vehicle cameras and dash cams as the main source of insights and the automatic evaluation through machine learning (ML) algorithms is novel in the sector. There are, in fact, two main aspects to focus on.

First, insurance companies and their technology partners must obtain clear and informed consent from policyholders to collect and process their data. The policyholder is then contracting the technology partner to process and evaluate the data to be provided with an objective assessment of their drives, e.g. a driving score.

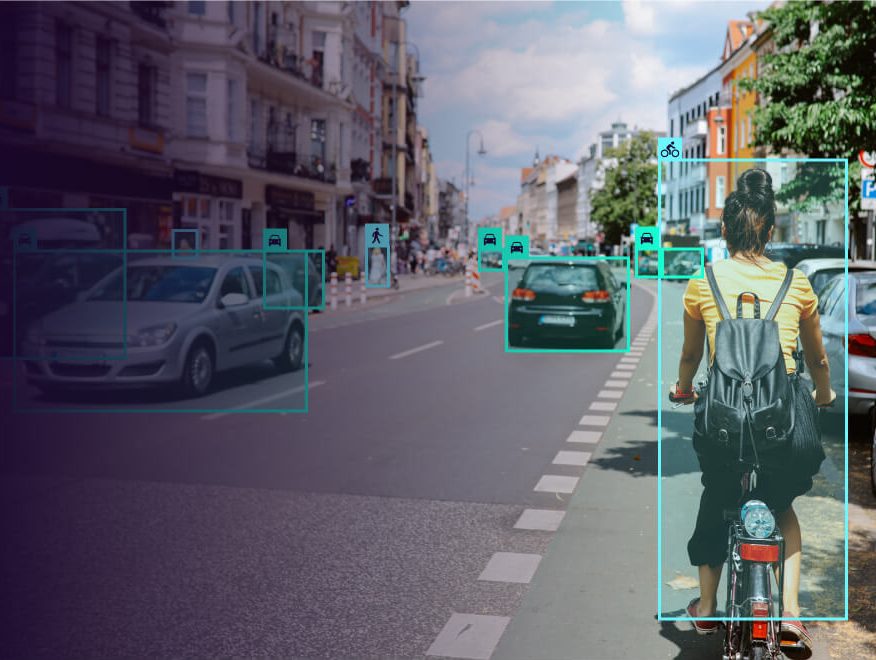

Secondly, environmental data processed by the smart cameras installed in vehicles needs to be balanced. On the one hand, to be kept to a minimum: only information that is identified as absolutely necessary to provide the requested assessment may be processed and stored. On the other hand, all stored visual information with high relevance for the service offering must not contain any personal data. Given this market setting: How does Peregrine leverage AI in our technology development to ensure that the processing and storage of video data preserve the privacy of all road users at all times?

Peregrine offers the technology that does comply with GDPR requirements and, thus, solves the data privacy challenge. We do so by using next-generation ML algorithms to automatically identify all forms of car registration plates as well as any human from the front and the side – a visible in-car person, a walking pedestrian or even a cyclist. We then point out areas in each video frame that contain personal data and process these in a way that they will be irreversibly unrecognizable.

This is what we at Peregrine call anonymization. In particular, our anonymization solutions, once created for our own needs, have been proven so efficient and cost-effective that they are used today by automakers to fulfill their data privacy strategy. Our technology improves daily through the use of millions of data points. We name this approach “the data flywheel”, as the continuous inflow of new edge cases is making it highly-trained and consistently state-of-the-art. In this way, our camera-based data opens the door for fresh innovations in the insurance market, all without the burden of GDPR compliance concerns.

All in all, camera-based policies represent the future of the auto insurance industry, as they offer tailored, efficient, and cost-effective coverage options for policyholders. Prioritizing privacy and security in the data strategy is essential to add customer value and is at the heart of Peregrine’s work.